Wrapping up Day 4 at PulseCore Events on Digital Banking Excellence, we delved into the fascinating world of Artificial Intelligence in the financial sector.

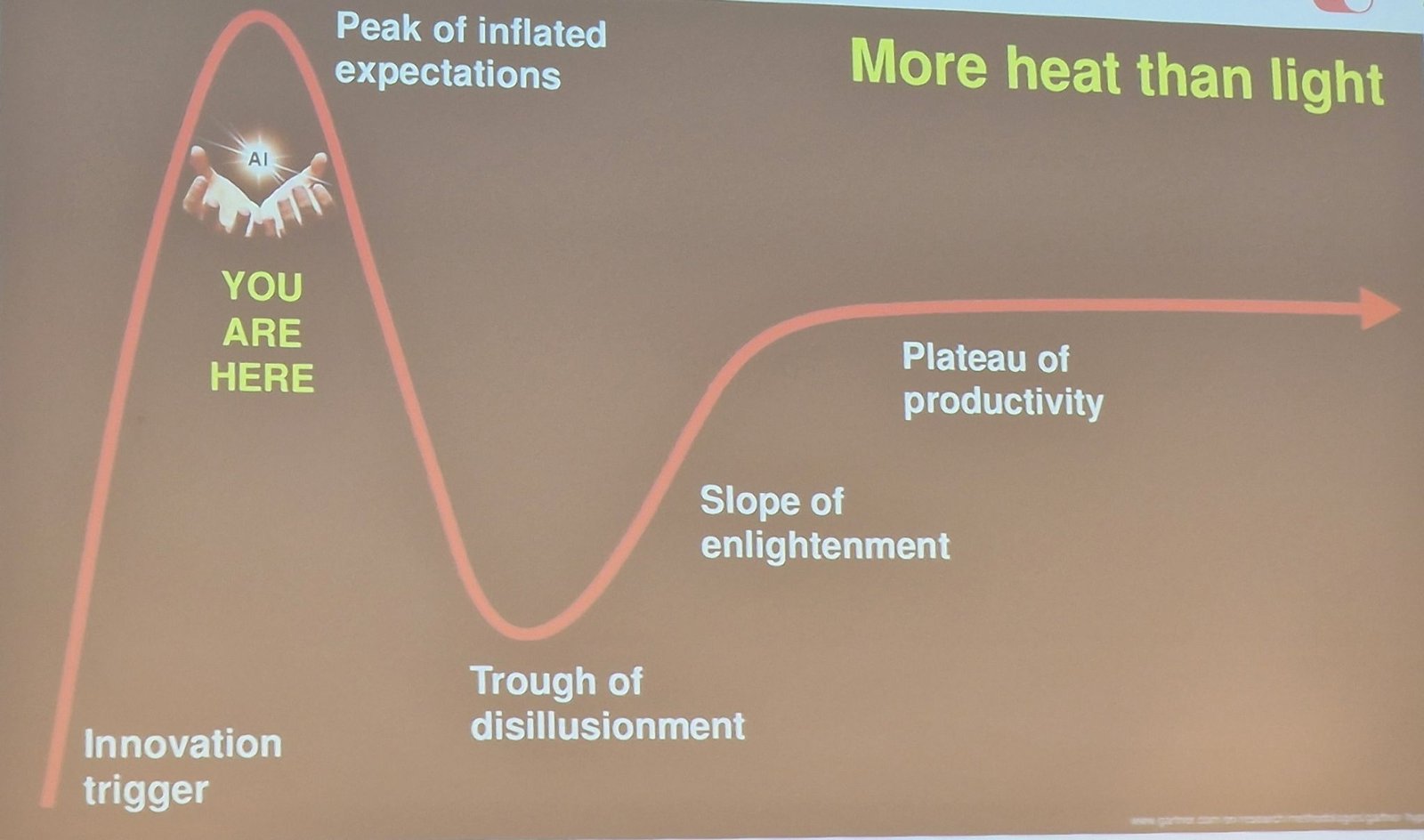

Day 4 at PulseCore Events showcased transformative insights on AI in the financial sector: Kate Fitzgerald (UK Payment Systems Regulators) outlined strategies for inclusive, secure, and competitive payment systems. Brinks (Netherlands) highlighted AI-driven ATM outsourcing for enhanced security, fraud detection, and customer experience. Joseph Mucheru (Jumo, Kenya) shared AI-powered solutions driving financial inclusion in emerging markets. Estrella Mota Perez (BBVA) emphasized evolving SME digital strategies with AI and user-centric approaches. David Porter (Bank of England) explored AI's ethical deployment and future potential. An inspiring day of collaboration and innovation with 350 participants, driving the future of digital banking!

Day 3 at PulseCore Events on Digital Banking Excellence was a dynamic journey filled with insights from industry leaders. Theme was Fintech!

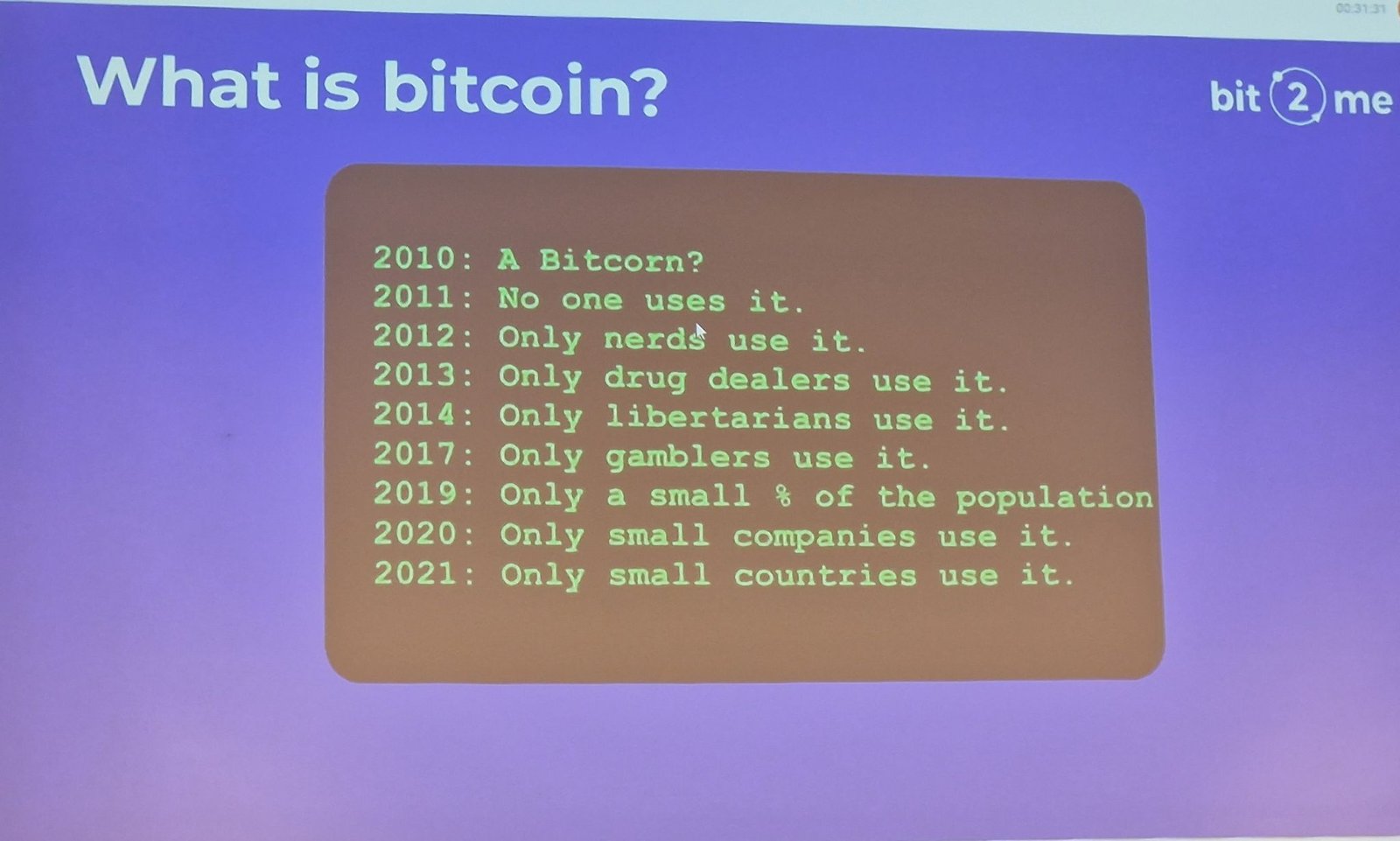

Day 3 at PulseCore Events was packed with inspiring talks on digital banking excellence, centered around Fintech innovation. Highlights included: - Tomas Reytt (mBank, Czechia) explored mobile-first strategies in digitally mature markets. - Halil Ozcan (Burgan Bank, Turkey) shared insights on building a competitive bank and key trends like AI and hyper-personalization. - Felix Hospe (Commerzbank, Germany) presented open banking strategies with real-world use cases. - Igor Korotach (Quantum, USA) examined the intersection of traditional finance and DeFi. - Gabriel Ayala (Bit2me, Spain) discussed Bitcoin's impact and crypto opportunities for banks. - Levent Kazim Oguz (DenizBank, Turkey) showcased innovative mobile platforms. - Laurent Lamblin (Everyone Invested, Belgium) emphasized emotional aspects in investment strategies. - Asli Gulem Gunduz (UPT Turkey) introduced niche digital finance solutions. - Nihat Narin (Belbim, Turkey) highlighted the transformation of Istanbul Kart into a fintech platform.

Exciting insights from Day 2 at PulseCore Events on Digital Banking Excellence, centered on the theme of Digital Identity and Digital Onboarding!

Explore the highlights from an impactful day at PulseCore Events! Discussions spanned transformative banking strategies, from enhancing physical branches into experiential hubs to seamless digital onboarding in countries like Turkey and Sweden. Industry leaders tackled pressing topics: Europe's lag in API adoption, ING's innovative business onboarding process, AI's role in AML compliance, and resilient business continuity strategies from Ukraine. Experts from HSBC, MoraBanc, and Intesa San Paolo emphasized hyper-personalization, ESG, and open finance's future. A convergence of traditional and neo-banking showcases the relentless drive for digital excellence and customer-centric innovation. Stay inspired!

Day one of the PulseCore Events on Digital Banking Excellence has been nothing short of inspiring!

Day 1 of the PulseCore Events on Digital Banking Excellence delivered an inspiring journey into the future of finance. From seamless remote account opening to Open Finance's trillion-dollar potential, thought leaders shared insights on mobile payments, app innovation, digital transformation, and security. Highlights included personalized banking strategies, democratizing access, and the rise of neo-banks like Salt Bank. With a spotlight on agility, customer engagement, and cutting-edge solutions, the day set the stage for reimagining digital banking. Stay tuned for Day 2’s focus on digital identity and onboarding!